Wednesday 31 December 2008

The Sterling Crisis

The catastrophe of Gordon Brown's response to the recession is becoming clearer by the day. By boosting public spending, he has shattered international confidence in the UK economy, and the predictable result has been a flight from sterling. There is a strange idea around that this is somehow good for the British economy. However, it is looking more like Robert Mugabe economics - let's call it Mugabenomics - every day. Printing money and devaluing the currency isn't the answer. Just take a look at what is happening to the Hugh Street. A whole string of retailers are going out of business - Woolworths, Whittards, Officer's Club, Adams - because most of the stuff they sell is imported. It's soaring in price, but they can't increase what they charge, so they are shutting down. The damage that does to the economy far outweighs any boost from the fiscal stimulus. In my Bloomberg column today, one of my predictions for 2009 is that Britain will have to call in the IMF - and that is looking more and more accurate all the time.

Tuesday 23 December 2008

The Rich Are Useless With Money

Plenty of pick-up for my Bloomberg column this morning on why the rich are so useless with their money. It is reproduced by The Times and Real Clear Markets.

Sunday 21 December 2008

Britain's Economic Mess

I liked Thomas Friedman's column in the New York Times this morning. You can read the whole thing on the link, but here's the key passage. "China is not going to rescue us or the world economy. We’re going to have to get out of this crisis the old-fashioned way: by digging inside ourselves and getting back to basics — improving U.S. productivity, saving more, studying harder and inventing more stuff to export. The days of phony prosperity — I borrow cheap money from China to build a house and then borrow on that house to buy cheap paintings from China to decorate my walls and everybody is a winner — are over." Spot on. But it applies even more forcefully to Britain than it does to the US. More borrowing, more state-aid, none of those are the answer. The UK economy needs to re-structure, which will involve some pain. It is extraordinary how few of the economic commentators in the UK are making this point.

Saturday 20 December 2008

Will Freesat Plus Scupper Sky?

I suspect the markets are far too complacent about the outlook for Sky. I've just installed the new Freesat + box and its a great piece of kit. The digital reception is very good, and I can record anything I like at the flick of a switch. There are more than enought channels there to keep the average person happy -a financial channel like Bloomber would be a good addition to the mix, but I'm sure those will come in time. Piece by piece, Sky's position is being eroded. You can get HD TV and recording facilities from Freesat. You can get sport from Setanta (or the web). You can get all the films you want from LoveFilm or your recorder. What exactly is Sky charging £40 a month or more for? It appears an increasingly arrogant organisation. Look at the way they put their prices up every year. Why? Most private companies reduce costs and prices. Sure, it works for a while. But Sky isn't a value proposition anymore, and in the mass market you have to be offering value. Once the consumers decides you don't, you are toast. You'll never get that reputation back.

Tuesday 16 December 2008

Military Intervention In Zimbabwe

Catherine Philp makes some telling poits in The Times today about military intervention in Zimbabwe. The British she argues care a lot more about what is happening there because we still feel partly responsibile for it, and the unfolding crisis hits home a lot harder than similar event in the Congo or elsewhere. But she thinks military force isn't on the cards. I wonder. The force would have to be a lot smaller than people imagine - my research for Fire Force suggests the Zimbabwean Army would crumble quickly against a modern, well-equipped army.

Monday 15 December 2008

Britain to Invade Zimbabwe

Reuters reports that the Mugabe regime in Harare is plotting to invade Zimbabwe. Oh, and the cholera outbreak afflicting the country is part of a plot to soften up the country before sending soldiers in. I was interested to see that because part of the plot of Fire Force, the sequel to Death Force, is that the President of Zimbabwe will use the threat of foreign soldiers interfering in the country, to bolster his regime. It's pretty obvious stuff really. Dictatorships usually do that. But it is still gratifying to see it coming true. The plot of the book feels more and more realistic all the time.

Monday 8 December 2008

Gold

Over at Bearwatch, they are having a go at me for the piece I wrote in The Spectator about gold. The graph shows the performance of the gold price over the since 2005. But you can prove anything with a chart. That was a commodity bull market, when the price of copper, wheat, oil etc soared. Over thirty years gold has done nothing - which is precisely the point I was making.

Using Force Against Mugabe

The calls for the use of military force against the regime of Robert Mugabe in Zimbabwe are growing all the time. The Archbishop of York, John Sentamu, called for that yesterday, and the Telegraph backs it up with an editorial today. I follow this with interest, since it is precisely the subject of the sequal to Death Force, called Fire Force. It looks as if the collapse of Zimbabwe is coming close to a tipping point where the country becomes a humanitarian disaster. But is there really an appetite for military intervention. I suspect a small mercenary force financed privately is still the most likely option.

Wednesday 3 December 2008

The Economics of Piracy

I was pleased to see my Bloomberg column on piracy getting picked up in papers in Seattle, Taiwan and India, amongst others. I guess people are interested in pirates - one reason I might well use that as the subject of the next Death Force thriller. My main point was that you can't deal with pirates until you deal with the chaos in Somalia. I have a feeling that in the next 20 years, the world is going to start getting involved in Africa again. You can't just leave a whole continent in chaos. But what? Not a neo-colonialist soilution - no one wants that. Something more imaginative is needed.

EMI Staggers Again

I only follow Guy Hands's acquisition of EMI here because whenever I write about them for Bloomberg, suggesting in the mildest possible terms that it wasn't the greatest deal ever, I get a furious call from their PR people. So it was interesting to read in the the FT today that more money had had to be put into the company and some of the senior managers had left. Still a great deal? I suspect it may be a while before it shows a profit.

Sunday 30 November 2008

Desperate Men For Desperate Times.

My book 'Death Force' will be out in only a few weeks time. One of the difficult things as a writer is getting the timing right. When I started with the idea, the British economy was still booming. Now it is heading into a major recession. I'm hoping that will be the right timing for a story about mercenaries heading off into war torn battle zones. Desperate men for desperate times. The Telegraph has a story today about recruitment to the armed forces rising, in response to the credit crunch. Hopefully that is a pointed that I'm onto something. We'll see.

Tuesday 25 November 2008

Are There Mercenaries in Georgia

One of the great things about writing a series of books on mercenaries is that there is never any shortage of subjects. The last few days have seen an explosion of stories about piracy following the attack on the oil tanker. Today, the Russians are alleging that there were foreign mercenaries fighting in Georgia during the brief war there last summer. Of course, they might well say that, and we're not sure we trust the Russian government. There are trying to justify what looked like a war of aggression. Then again, Georgia is a very small place, and it wouldn't be that surprising if they hired some outside help.

Sunday 23 November 2008

The Economics of Piracy

The New York Times has an interesting discussion of the economics of piracy. Ships wouldn't be getting hijacked off the coast of Somalia unless it was a profitable trade. The interesting question is how the economics wok out in the medium term. Eventually, the shipping trade will have to decide whether it is cheaper to pay protection money to a Somalia warload to stop their vessels getting hit. Or is it cheaper to pay a military force to go and deal with the pirates?

Wednesday 19 November 2008

Sorry About That Hedge Fund

Both the Wall Street Journal and The Times are running my Bloomberg column about how hedge funds need a better class of excuse. Ypu can read the original here. I got a lot of feedback on that piece, mixed as usual, but mostly positive. Quite a few hedge fund managers e-mailed me. I suspect they know the industry is in trouble because the performance all through the credit crunch just hasn't been good enough.

Monday 17 November 2008

Britain & The Euro

I've been arguing here for a while, and in my Bloomberg column, that the recession would re-open the case for Britain joining the euros. Wolfgang Munchau has a well argued piece in the FT today making precisely that case. Yesterday Will Hutton was making the argument in the Observer. I suspect this is going to grow. Sterling is in real trouble, and so will the British economy be in due course. The euro is going to be an obvious escape route. The problem will be that Gordon Brown will have spent so much money, and the accounting will be so dodgy, we probably won't qaulify. They let the Greeks in by fiddling the numbers. But I suspect the ECB won't want to take on responsibility for the catastrophic mess Brown in creating.

Bankers Bonuses

Back in January, I wrote a column for Bloomberg suggesting that bankers at firms such as UBS and Morgan Stanley should be made to hand back their bonuses. The argument was fairly simple: the deals had gone pear-shaped, and so they didn't derserve the money. The column took a fair amount of flak on some of the financial blogs. So I'm pleased to see that the UBS is reported this morning to be planning to re-claim some of the bonuses it paid out in previous years. Good for them. It is time investment bankers learnt that bonuses aren't just free money. You actually have to earn them.

Friday 14 November 2008

Italy & The Euro

I wonder how long the Italians will persist with the euro. Today we learnt that the country has entered its fourth recession in the past ten years. Before it adopted the single currency, Italy was doing pretty well. The establishment decided that the problem for the country, however, was its pernamently weak currency, and so enthusiastically swapped the lira for the euro. They turned out to be wrong. Italy did much better with a weak currency. It's so obvious that the euro has worked out badly for the Italians that at some point even the political class running the country must be able to figure it out.

Wednesday 12 November 2008

The Flight From Sterling

Te flight from sterling is accelerating, with the pound down to new lows against the dollar, and record lows against the euro. Now there are signs of a sell-off in the gilts market as well. The idea that the UK government is going to be able to painlessly raise £100 billion in borrowing to spend its way out of recession is laughable. The bond and currency markets will expose that, particularly with Gordon Brown intent on making his fiscal irresponsibility into a virtue. It's always a sterling crisis that is the undoing of a Labour Government. This one doesn't look like being any different.

Re-Routing Shipping To Avoid Pirates

There is a fascinating nugget in the FT today, noting that at least one big shipping company has startede re-routing its vessels around the Cape of Good Hope, rather than send them through the Suez Canal and risk attack by Somalia's pairates. Fairly obviously, decision like that are adding huge costs to world trade. It can't be long before a major assault on the pirates in unleashed.

Wednesday 5 November 2008

New York Times On Pirates

The New York Times has a great piece on Somalia's priates, which is likely to be the subject for the third in my Death Force series of books. What it makes clear is just how much piracy has been integrated in the local economy. It's a way of life, just as it was in the eighteenth century.

Monday 3 November 2008

Why Isn't the BBC's Director-General Elected?

Amid all the controversy over Jonathan Ross and Russell Brand, one thing puzzles me. Why isn't the Director-General of the BBC elected by the license fee payers? After all, the chairman of a company is elected by the shareholders - or at least submits himself to a vote. The board of a charity such as the National Trust is elected. So is the chairman of the local golf club. Why are the people who pay for the BBC not allowed any say in how it is run? The Director General should be elected by the license fee payers, on the basis of one license, one vote. Different candidates should run. Some could be more populist and argue for a higher license fee. Others could argue for a £50 fee and a smaller BBC. It would certainly be amusing seeing anyone trying to defend paying £6 million a year to Jonathan Ross in an open election.

Wednesday 29 October 2008

Top of the Pops

One of the thing I enjoy about writing for electronic media is that you can see clearly waht people want to read about. My Bloomberg column on the return of the MBA was, I see, the most read story on RealClearMarkets.com yesterday. It got a lot of hits on Bloomberg as well. I guess a lot of bankers out there are thinking about what to do next with their careers.

Wednesday 22 October 2008

The Pound Is Always Trouble For The UK

In my Bloomberg column I've been writing about the potential for a sterling collapse for some time. Indeed, I went off warning about it, because it never seemed to happen. Now, with the pound down to $1.62 from $2 in the space of a few weeks, it looks to be on the way. In Britain, an economic crisis is always in the end a sterling crisis, and this time around it looks no different. The UK econoy needs to be understood as a currency bubble, which is what has allowed the country to appear so prosperous. With that bursting, the trade deficit is going to be an issue again. So too is the fact that so much of government debt is funded overseas. Why would you want to buy that in a rapidly depreciating currency? There is a complacent assumption out there that so long as the Bank of England slashes interest rates, and the government pumps up spending, the economy will get through the downturn. But a collapsing currency puts real constraints on that, because it pushes up the cost of imports, and may make it impossible for the government to borrow more money.

Friday 17 October 2008

Mercenaries Vs Pirates

The notion of using mercenary forces to tackle the pirates off the coast of Somalia is gaining ground. Indeed, the giant US private miliary corporation Blackwater has just put out a press release volunteering its services. Since shipping insurance rates have risen ten-fold this year because of the threat from pirates, you can see why it makes sense. As a plot line for the third book in the Death Force series, this is looking better all the time.

Wednesday 15 October 2008

More Nonsense From Vince Cable

Vince Cable continues to be the most over-rated man in Brtitish politics. At Prime Minister's Questions today he's arguing that the government should tell the Bank of England to cut interest rates. But surely the independence of the Bank is about the only worthwhile reform of the British government in the last 10 years? Indeed, I seem to remember interviewing Cable for a Bloomberg column some time ago when he criticised Gordon Brown for telling the Bank what to do. As it happens, the Bank will cut interest rates dramatically over the next six months anyway..but once it starts taking instructions from the government its independence is gone forever. Surely even Cable can figure that out.

Monday 13 October 2008

Krugman's Nobel Prize

The decision to give Paul Krugman the Nobel Prize in economics is the surest indication yet that the world is starting to swing away from the neo-liberal economics that have dominated the world for the past the three decades. I interviewed Krugman once, and I liked him. He's an intelligent man, and his column in the New York Times is always readable. But he is, for an economist, extreme in his anti-market views. The credit crunch is going to make that fashionable. But I suspect we'll pay a price for it in the long run.

Sunday 12 October 2008

The Taliban's Money

Accoridng to reports in the FT and elsewhere, NATO has now decided it has to directly target the Taliban's drugs trading operations in Afghanistan. It is, they've concluded, the only way they are going to defeat then - a rich enemy is a powerful enemy, and the drugs trade is funnelling millions into the hands of the Taliban. It is, of course, precisely the plot of Death Force, my book which is coming out in January. Who knows, they might even be hiring mercenaries to do the job for them.

Wednesday 8 October 2008

Russia Doesn't Nationalise It's Banks

Among the many ironies of the credit crunch, this one probably deserves more comment. About the only major economy that isn't nationalising, or semi-nationalising, its banking system is Russia. The Government is supporting it's banks but not looking for control in return. Maybe because that is because they know what a state-controlled banking system is like.

Monday 6 October 2008

Pirates vs Mercenaries

One of the great things about writing a series of books aboug a gang of mercenaries is that there is never any shortage of things to write about. I've already been thinking about setting the third book in the series in the pirate-infested waters off Somalia. But in the blogosphere, the idea is already out there already. Excaliber Forums thinks Lloyd's shipping insurers could pay, and it's not a bad idea. After all, people pay for private security for their offices, factories or oil rigs. Why not their ships as well?

Wednesday 1 October 2008

Gordon Brown and HBOS

I womder if it was wise for Gordon Brown to invest so much personal capital in the Lloyds TSB rescue of HBOS? The markets are turning rapidly sour on the deal, and it still has to be approved by the Lloyds shareholders. Which way will they vote? I don't think the fact that it will be a terrible blow to the Clunking Fist if the deal fails will persuade them to vote in favor. Quite the reverse, in fact. Putting himself in the hands of the Lloyds shareholders may yet prove another terrible error by the PM.

Tuesday 30 September 2008

Did We Need To Nationalise Our Banks?

There hasn't been enough discussuion about whether the government really did the right thing in nationalising Bradford & Bingley as well as Northern Rock. Were there simpler ways out of the crisis? The Irish goverment has just offered to guarantee the deposits in all its main banks. That has much the same impact, but without all the drawbacks of nationalisations. Or the government could have just offered 25p a share for B&B stock in the market. That would have steadied the price. I have just been looking up the antics of some of the state-owned French banks for a column for Bloomberg. Credit Lyonnais ended up own the MGM film studio - fun for the bankers, but not muhc fun for the taxpayer. I suspect we are going to end up regretting this.

Wednesday 24 September 2008

British banks

The Times are running my Bloomberg column this morning. Amid all the doom and gloom about the UK economy, it seems to be both Barclays and Llouds have done great deals for themselves. It won't be enough to save the British economy from recession - but at least the banking industry will be in good shape.

Sunday 21 September 2008

Lloyds and HBOS

I wonder if the Lloyds-HBOS merger might not be Gordon Brown's legacy - it certainly looks to be the only thing of significance he has done so far as PM. But it won't be a happy one. In effect, he has allowed a private sector monopoly to be created. That's great news for Lloyds shareholders, but bad news for every one else. Brown clearly understand that competition is vital for a free market - so much for the great economist! Naturally, there were plenty of alternatives. The Treasury could have just said it would buy every HBOS share available at £2. That would have burnt the short-sellers and stabalised the share price. Instead, he panicked, and created a mess that will have to be unpicked another day. I don't think the public will buy into his 'I saved the economy routine.' In time, they will just notice that Lloyds-HBOS is acting a predatory monopolist and know who to blame.

Thursday 18 September 2008

Short Selling

Listening to the BBC's coverage of the unfolding financial crisis, they appear to have become obsessed with short-selling. They are helped in that by idiots like Vince Cable, who is fast becoming the most over-rated politician since Gordon Brown (whom the BBC and much of the left also used to think knew something about finance - until they found out otherwise). But short-sellers are not creating the crisis. Indeed, anyone who was shorting HBOS as the price collapsed in the last couple of days will have taken a beating, as the shares are now above 200p again. No one at the BBC seems to understand this. As for calls to clamp down on short-selling, that isn't so much shooting the messeneger, as deciding to suffocate the messenger under lots of pointless red-tape. It is completely irrelevant.

Wednesday 17 September 2008

The Taliban's Finances

It's surprising given that Britain is fighting a vicious war in Afghanistan that so little attention is paid to the Taliban, the enemy it is taking on, and where it gets its money from. There is an excellent piece in the Telegraph today discussing precisely that. The opium trade is keeping the Taiban rich, and that means they have plenty of weapons and plenty of troops. At some stage, the British are going to have to try to deal with that. Which is where the plot of Death Force starts...the attempt by the British to cut off the flow of money to the Taliban.

Monday 15 September 2008

Gordon Brown's Cones Hotline

I suspect that his proposals on loft insulation may well have finished off Gordon Brown. He spent the whole summer briefing that he was going to re-launch in the autumn and then...well, he came up with a fiddly scheme to give people a discount on their lagging. It is hardly surprising that even his few remaining supporters lost the will to live. It is a rather like the cones hotline in the dying days of the Major administration - a decent enough, well-meaning idea, but completely devoid of the inspiration needed to save a government. In many ways it's a shame. I was looking forward to the beating Brown would take in an election campaign. But it's hard to see him surviving now - particularly when you think about how awful his conference speech will be.

Saturday 13 September 2008

Stephen Green On Banker's Pay

The BBC is letting the Stephen Green get away with a little too much organised hypocrisy today. The HSBC chairman is complaining that extragant bankers pay may well have contributed to the current financial crisis. It is a fair point, if not a very original one. But hang on. Is this the same Stephen Green who allowed HSBC to go on a massive hiring spree to beef up its own not-very-good investment bank? That wouldn't have done anything to push up pay and bonuses would it?

Monday 25 August 2008

How Does Mugabe Stay In Power?

The sequal to 'Death Force' is called 'Fire Force' and is set in Zimbabwe. I've been doing lots of research on the country as I write the book, and my favorite writer on the country is Peter Godwin. His piece in Vanity Fair is brilliant. As he correctly points out, Mugabe didn't turn to violence and repression once the economy turned sour. He used it right from the start - it is just the rest of the world chose not to look.

Herlmand's Opium Crop

According to this report, there is likely to be a record opium crop in Afghanistan's Helmand province this year. The central premise of 'Death Force', my upcoming thriller from Headline, is that the opium money is being used to finance the war against the British Army there. They won't start winning the war until they cut off the suppply of money. It is a pretty simple point, and one that makes a good basis for a story. But if it has occured to me, it must have occured to someone in the Army as well? Surely some raids on the drugs lords are taking place - and if not, why not?

Friday 22 August 2008

How Strong Is Russia?

Most of the discussion around the Russian invasion of Georgia seems to assume that the country is still a powerful enemy, the same way it was during the Cold War. But that surely is a mistake. Russia has been booming economically, but that is the result of the oil price being so high. It increasingly look like Saudi Arabia with snow. The money is being squandered on arms spending, and by playboys in London. It isn't being used to build a modern economy. Meanwhile, it has a rapidly falling population, which means there won't be many 18-year old boys around to invade even tiny nations like Georgia.

Zero Percent Growth

British economy grew by zero per cent in the latest quarter according to the latest figures. Does that count as being in recession or not? We wait with interest to see how Gordon - "I abolished boom'n'bust" manages to spin that one.

Saturday 9 August 2008

Mercenaries for Africa

The Wall Street Journal has run an interesting editorial piece wondering whether a mercenary force shouldn't be sent into Dafur to try and sort the place out. It quotes Erik Prince, the controversial founder of the Blackwater private militart corporation, advocating a force of about 250 trained men, who would in turn train up a larger force of African soldiers. Could it happen, I wonder? I suspect it might, although it will be a long time before we are ready for it. Billions are being spent on aid to Africa, but we all know the problems are more political and military than economic. Until you have stable governments, with the rule of law, there isn't going to be any real progress. That mean toppling the madmen. In the long run it would be far cheaper and far more effective to employ a mercenary force to impose order. People will resist the idea, largely because of the legacy of colonialism. But it so obviously makes sense, I suspect they will come around to it eventually.

Wednesday 6 August 2008

Paris Hilton Has a Brain Shock

Is it possible that Paris Hilton has a brain? If not, how can you explain the fact she's made a realy funny video about the American presidential election?

Tuesday 5 August 2008

Greenspan Defends Himself

Anyone interested in the debate over the credit crunch should take the time to read Alan Greenspan in the FT this morning. The great man is as lucid as ever. Ever since the credit crunch started people have been queuing up to blame deregulated capital markets. Yet as Greenspan points out the real problem is the tendency of human beings to swing between euphoria and despondency -- and that is true of any economic system. He's certainly right about that. Of course, if he owed up to the fact that his failure to prick the housing bubble in the US was also part of the problem, he might be even more convincing.

Friday 1 August 2008

Milliband Falls Flat

Am I the only person who thinks David Milliband now looks like a bit of a twerp? Surely, if he wanted to challenge for the leadership, he should have resigned and stood against Gordon Brown. He'd probably win - although he is so untested in front-line politics it is hard to say how he'd fare in an actual campaign. Instead, he expects the job of PM to fall into his lap. This week will be the first time most people have heard of him, and I suspect he hasn't come across as bold, decisive or brave. He's come across as someone who makes snide remarks, then goes off on holiday.

Thursday 31 July 2008

Touching A Nerve On Oil

I notice that my Bloomberg column on the oil price was the most read piece yesterday on Real Clear Markets. That is interesting in itself. I suspect that many people like me are watching the oil price as the best single indicator of where the global economy is going. At $140 to $150 a barrel, it's going down the tubes. At $80 to $90, the crisis is cancelled. Right now, it is hovering somewhere between those extremes.

Wednesday 30 July 2008

The Demise of Labour

There's a great piece in the Telegraph about the deminse of the Labour Party by Ian Martin. Increasingly, Labour looks like the trade union party, similar say to the French Communist Party. But what's the core vote for a union party in modern Britain. I'd say somewhere between 5% and 10% of the electorate. As I've said before, this is going to get a lot worse for them.

Saturday 26 July 2008

Friday 25 July 2008

The Stones and EMI

Whenever I write anything about the private equity financier Guy Hands - such as this piece for Bloomberg - I get a furious phone call from his PR man Andew Dowler at Financial Dynamics accusing me of irresponsible journalism. So what should one make of the fact that The Rolling Stones are leaving EMI? Well to save on Mr Dowler's phone bill, I'll just say it's great news for EMI. Who wants to listen to that old rubbish anyway. Hands has recruited Elio Leoni Sceti from Reckitt Benckiser, which makes products such as Finish diswater tablets, and lost Keith Richards. Surely no one could argue that wasn't the right way to run a record label - could they?

Glasgow East - It Just Gets Worse For Labour

The real point about the Glasgow East by-election disaster for Labour is that things just keep getting worse for Labour. It's a bear market, and I don't think we are anywhere near the bottom yet. I've blogged on this point before, but eveything that has hapened since just seems to confirm it. Blairism was like Gaullism. Without the General, there wasn't any such thing as Gaullism anymore. It was entirely built around a single personality. The same with Blair. Now that he is gone there is nothing left to lead. So the idea that there is some natural 'bedrock' the Labour Party can fall back on is nonsenical. It's zero.

Thursday 24 July 2008

More On The Oil Price

Top add to yesterday's points on the oil price, a couple more indicators that the turning point has been reached. A French company called CMTV is putting out sailing ships to carry cargo. And why not? Most cargo isn't in any great hurry. Ships were only using oil because it was cheap and easy. Meanwhile the FT reports that another 90bn barrels of oil lies waiting to be exploited in the Artic. Demand is coming down and supply going up - just as you might expect after a spike in the price. Soon prices will be coming down as well.

The British Recession Gets Worse

The Irish Independent has picked up my Bloomberg column this morning about the recession that is looming for the UK. The news today is, of course, even worse, with a 3.6% drop in retail sales, the worst monthly figure since 1992. The point is that the economic news keeps surprising us on the downside. So long as that is true, the outlook is grim. And, as I keep saying, we haven't seen the attack on sterling yet, which is where it really get nasty. But I think we can be sure that the turning point hasn't been reached until there is a significant devaluation of the currency.

Wednesday 23 July 2008

Mercenaries wages

The Glasgow Herald reports that Private Security Corporation staff in Iraq - otherwise known as mercenaries - are making £250 a day, or £7,000 a month. It's a good wage, I suppose, although given the risk of dying, it's hardly a fortune.

Has The Oil Price Turned

Probably the most interesting question in the financial markets right now is whether the oil price has turned. The fall in the past couple of weeks has certainly been dramatic: oil has shuttled back down to $126 a barrel from its peak in June of $145. Lehman Brothers are predicting that it will be back down to $90 by the start of next year, which may well be the new long term price. What happens to oil matters because it may well signal a turning point for the global economy. If oil falls, inflation will drop back, and central banks will start cutting rates again, helping out crumbling property markets and flagging consumers. So, if you only want to watch one price, watch that one.

Tuesday 15 July 2008

Faulks as Fleming

My review for Bloomberg of Sebastian Faulks's James Bond book has been collated along with a lot of the American reviews of the book on one of the Bond fan websites. Reading through them, it's interesting that the American reviews were a lot more hostile than than the British ones. I suspect that the American thriller audience is a lot more demanding than the British one - and Faulk's glib effort won't satisfy that market.

British vs American Journalism

There's a good piece in the FT today by Gideon Rachman dicussing the difference between British and American journalism. His conclusion is that although a lot of American journalism may be boring and stuffy, its worthiness is still preferable to the sloppiness of much British journalism. I tend to agree. I worked at The Sunday Times for ten years, and then started writing a column for Bloomberg. The insistance on fact-checking at Bloomberg is a drag sometimes, but the net result is surely better. American journalism is, in the end, more satisfying for being accurate. Meanwhile, the British press would do better to ponder its declining circulations, and wonder if it is really doing everything right.

Tuesday 8 July 2008

Simon Mann

There's a great piece in the Independent today about the Simon Mann coup plot. A must-read.

Monday 7 July 2008

Crisis What Crisis says Jim Brown

Probably the end of the last Labour Goverment came when Jin Callagahan was reported as saying 'Crisis? What crisis?' . Even though he was apparently misquoted, it showed how out of touch he'd become. I wonder if Gordon Brown telling us to watch what we spend on food will mark a similar point - a final nail in the coffin of a collapsing regime. After all, most of us know that the reason we have less money is because of his mis-management of the economy. Telling us its our fault, and we should just econmise, is only going to make things worse. Yet again, his ability to completely mis-read the public mood is breathtaking.

Sunday 6 July 2008

Mercenaries

There's a nice review in The Guardian by Peter Beaumont of a new book on mercenaries called War Plc. He makes the point that warfare has been extensively privatised, with PMCs carrying out many of the tasks that used to be performed by conventional soldiers. The Independent makes a similar point, with a story about how British bases in Afghanistan and Iraq could be protected by private firms. I suspect this trend is going to continue - a theme I'm exploring in my fictional series Death Force which kicks off in January. The 20th century very much belonged to big public armies, but before that warfare often belonged to small, private armies (or at least private-public partnerships). Many people seem to think there is somehting odd about the return of the mercenaries, but you could just as well view it as warfare getting back to normal.

Thursday 3 July 2008

The UK Faces Recession

Every set of numbers released right now suggests the UK is slipping into a serious recession.The housing market is collapsing, retail sales are falling, and now both manufacturing and and services are slowing down sharply. This could well get nasty. The UK should have had a sharp correction in 2001/2002 but Gordon Brown unleashed a tidal wave of government spending, the first that Britain had seen for thirty years or more. That created an illusion of prosperity that has been unsustainable. People are drwing comparisons with the last recession of 1990/91, but that was mainly caused by currency problems. Once those were cured - fairly simply by pulling out of the ERM - the underlying economy was pretty sound. That isn't true today. The underlying economy is over-taxed and over-borrowed. In fact, this could well be the worst recession since 1980/81.

Tuesday 1 July 2008

Bond - Craig vs Faulks

For everything that is wrong about Sabastian Faulks's new Bond book 'Devil May Care' take a look at the trailer of the new Bond movie Quantum of Solace. At least the film makers understand what Bond is all about - modern, edgy, cool - even if the 19th-hole bores that re-created a 1960s's Bond don't.

Sunday 29 June 2008

Military Intervention in Zimbabwe

The number of people advocating some kind of military intervention in Zimbabwe is growing all the time. Sir Malcolm Rifkind is arguing the case in the Sunday Telegraph. So is Martin Ivens in the Sunday Times. The points are all perfectly sensible ones. It still seems to me, however, that the greatest threat comes from a band of mercenaries - the plot I decided on for Fireforce - rather than an Western or African army.

Saturday 28 June 2008

Investment Banking

One of the consequences of the credit crunch is going to be a big change in the way the investment banks work. The swaggering, deal-making culture is going to have to change. The banks will probably have to start going back to their roots - working for clients, operating like partnerships, thinking long-term. The interesting question is how they get there. One way, would be to merge with some of the private equity houses, who have plenty of money, and also the kind of long-term, partnership culture the banks need to re-create. So it is fascinating to see two senior executive from Carlyle Group, Olivier Sarkozy and Randal Quarles, arguing in the Wall Street Journal that the rules should loosened to allow private equity firms to own banks. I think they've had the same thought -- and as soon as they are allowed to, the private equity moguls will start buying banks. In the UK, we've already seen the start of it with TPG taking a stake in Bradford & Bingley. But we will see a lot more before the credit crunch is over.

Thursday 26 June 2008

One Year Of Gordon Brown

On his first anniversary, there seems to be an idea out there that things can't get much worse for Gordon Brown. But surely that is to complacent. In truth, measured by any objective standards, he's had a pretty easy year - it's just his absymal, cack-handed response to problems that makes it look bad. There is still a serious recession to come, a potential foreig policy disaster, and a high-profile ministerial crisis. It will get much, much worse.

Tuesday 24 June 2008

Zimbabwe

In The Times, David Aaronvitch has joined the chorus calling for Western military intervention to topple Mugabe. How many men would it take, he wonders, although he doesn't get around to answering the question. In the book I'm witing - Fireforce, the sequal to Death Force - the answer is ten. I think I'll send him a copy when it's out.

Monday 23 June 2008

A coup in Zimbabwe

The Washington Post has a fascinating piece by Paul Collier, professor of economics at Oxford, arguing in favor of a coup in Zimbabwe. The argument is simple enough: there is no stomach for military intervention, so why not get the Army to do the work. Of course, it rather ignores the point that there has already been a coup: the Army is effectively running the place. Anyway, it interested me because my next novel - Fireforce - is based on exactly that premise: A coup in Zimbabwe - or rather an assassination by a small band of mercenaries financed from abroad.

Saturday 21 June 2008

Mercenaries

There's a lovely piece in The Times today by Ben Macintyre about how Simon Mann fits perfectly into the fictional tradition of mercenaries. I think he's right about that. Mann gets a lot of coverage because he is a mercenary novel made flesh: a swashbuckling adventurer creating havoc in small African states. He refers at lenght, however, to Frederick Forsyth's The Dogs of War as a classic of the genre. I'd have to disagree with him there. I rate Forsyth as the BMW of thriller writers: not much character, but the most brilliant engineering you have ever seen. I re-read The Dogs of War recently, however, having first read it when it came out, and I was about 12. It's a fantastically boring book, by far the worst he ever wrote. It goes on for about 500 pages, and the actual fighting doesn't start until page 480. Most of the time, the hero is setting up bank accounts in Bruges, then getting the ferry back to Britain. As a foot passanger! Exciting stuff.

Friday 13 June 2008

David Davis vs. Kelvin MacKenzie

Most of the media appear to be portraying David Davis's decision to resign as a problem for the Conservatives -- and as good news for Gordon Brown. I'm not so sure. Take this morning's news that the former Sun editor Kelvin MacKenzie will be backed by The Sun and Rupert Murdoch as his main opponent. It is pretty dismal for Brown when his flagship policy can only find Murdoch to support it. In reality, Brown is in such a deep hole now he needs a core vote strategy. He needs to stabalise his position before he can claw back support - there is no point chasing after Daily Mail readers because they aren't even listening to him. The Davis vs MacKenzie by-election will demoralise and depress Labour supporters. Why, they will ask themselves, should they support a reactionary loser. It will just prompt more defections to the Lib Dems, perhaps putting them ahead of Labour in the polls. Once that happens, Brown is in freefall.

Tuesday 10 June 2008

The Wierdness of Gordon Brown Part 458

The Times reports this morning that Gordon Brown is hitting yet more all-time lows in the polls: 25% for Labour, 20 points behind the Conservatives, which is as bad as it has ever been for Labour on ICM figures. But you just don't have to look far to see why it is so bad. A day earlier, the 100th British soldiers died in Afghanistan (where, incidentally, my upcoming book Death Force is set). You might expect the PM to come up with a clear statement of what the mission was and what they died for. After all, there was plenty of time to prepared for that milestone. All Brown could manage was a bland statement about their 'sacrifice' that has been delivered a hundred times already. That isn't even beginning to show leadership. It gets more dismal by the day, and Labour can go a lot lower still. The next interesting point, I suspect, is when the Lib Dems overtake Labour in the polls.

Friday 6 June 2008

Warren Buffett

In the Spectator this week, I've been writing about Warren Buffett's decision to start buying companies in Europe. I hadn't really spent much time studying Buffett before starting the piece, just general knowledge. He really is a fascinating character, and the more you read about him the smarter he seems. USA Today also has a really nice piece about him that is worth reading. Anyway, it's a bit like Wagner - daunting at first, but once you get into it, impossible not to become a fan.

Thursday 5 June 2008

Wednesday 4 June 2008

Dealbreaker

An accolade of sorts is to have Dealbreaker make fun of one of your columns. Actually, the discussion has some pretty good points.

Tuesday 3 June 2008

Britain and the Euro

The maverick economist William Buiter has started a debate on whether Britain should join the euro, which has been picked up by Felix Salmon over on his blog. I predicted a few weeks ago in my Bloomberg column that the debate on the euro was about to re-start, so I'm pleased to see it happening. It's easy to dismiss the euro when 1) your currency is strong and 2) your economy is doing well. When those go into reverse, as they about to, then suddenly the euro will look a lot more attractive. I'm not convinced it is going to happen - not yet anyway - but the conversation is getting going again.

London's Next Bonanza

London has taken a lot of blows as a financial centre in the past few months. It has been hit by the credit crunch, by the non-dom rules changing, and by the collapse of Northern Rock. But now there is a stroke of luck. The Americans are angry at hight oil prices, and blaming specuators. Seneator Lieberman is planning a tax on investments in commodities, according to a story in the New York Times. In Europe, the French and the Austrians are preparing bans on futures trading. Nothing could be more certain to drive business to London. You can't stop speculation by banning it or taxing it - you just send it somewhere else.

Saturday 31 May 2008

Faulks As Fleming

I've been reviewing Sebastian Faulk's James Bond book 'Devil May Care' for Bloomberg. The advance hype was very favorable, but I notice the later reviews are far harsher. Rightly so. Faulks really was an odd choice - why not one of the SAS ghost-writers, for example - for the job. I like his books, but I stopped reading them after 'On Green Dolphin Street', his attempt at a thriller, becasue he simply can't do excitement. I can't help feeling both Penguin and The Fleming estate missed a trick. They can't get all this publicity again. They could have re-launched the series with Bond set in the modern day, and with a writer who could both re-create the genre, and write a series of books. It's an expensive mistake.

Thursday 29 May 2008

Oil Prices

We keep reading that the world is running out of oil, as if that explains why the price has gone crazy in the last few months. But Russia's Lukoil announced today a new oil find in the Caspian Sea with 3.8 billion barrels of oil and 91.7 billion cubic meters of gas. Don't listen to the peak oil nonsense. It's a bubble.

Commodities Bubble

Over at Bloomberg, I've been writing about the oil and commodities bubble. I was arguing that it was the market at work. An oil price shock is going to force people to increase production, and cut consumption, which is what the world needs. It's the market at doing what it should be doing - brutal, perhaps, but effective. There was a lot of feedback on that one, most of it positive, which shows the financial community is more sophisticated on these issues than the mainstrean media.

Tuesday 27 May 2008

French book prices

As someone who is interested both in the book trade, as an author, and economics, as a journalist, I find it extraordinary that the French as still debating whether to change their version of the net boook agreement - and, according to a report in The Bookseller, look like keeping it.

Nothing could better illustrate why France remains in the dark ages. After price controls were abolished in the UK, we got Waterstone's, Border's etc - big friendly bookshops that made buying book a pleasant experience. I also think Tesco, Asda are doing a lot for the books business - after all at £3.50 a book is a small, tempting luxury when you are out shopping. By contrast, has anyone ever seen a decent bookshop in France? Or read a French author recently? The British bookselling industry might be frustrating but it miles ahead of the French.

Nothing could better illustrate why France remains in the dark ages. After price controls were abolished in the UK, we got Waterstone's, Border's etc - big friendly bookshops that made buying book a pleasant experience. I also think Tesco, Asda are doing a lot for the books business - after all at £3.50 a book is a small, tempting luxury when you are out shopping. By contrast, has anyone ever seen a decent bookshop in France? Or read a French author recently? The British bookselling industry might be frustrating but it miles ahead of the French.

Sunday 25 May 2008

Blairism/Gaullism

I posted a few weeks ago on how Blairism was looking more and more like Gaullism - a political movement that was all about a single individual and which didn't really exist anymore once that person was gone. As events unfold, I think that is looking more and more true. Gordon Brown is imploding, even though nothing much has gone wrong. The Labour Party is casting around for another leader but it is hard to believe things would really get much better under David Milliband or Alan Johnson. Without Blair, there's nothing there to lead. Somewhere at the bottom of all this there is the old Labour Party. But I suspect things will get a lot worse for them: succession of failed leaders, probably. It is of course good news for those of us who would prefer a centre right government anyway.

Tuesday 13 May 2008

Northern Rock

Over at the FT's Alphaville blog there is an interesting story about how the number of borrowers falling behind with their mortgages has jumped sharply at Northern Rock since the bank was nationalised. But of course that was to be expected. After all, Gordon Brown is in such a deep hole already the last thing he is going to do is start evicting people from their homes, particularly when they are mainly Labour voters in the North-East? So why not take a break on the re-payments? This is set to get a lot messier yet. And it shows again how if Brown wasn't such a ditherer he would have sold it to Lloyds TSB or one of the other High Street banks on day one.

Saturday 10 May 2008

Spectator Business

The Spectator has launched its new business magazine, Spectator Business. It looks pretty good - but maybe that's because it has a piece by me (and my wife Angharad as well). But, more seriously, when people have launched business magazines before in Britain they have tried to copy Fortune and Forbes. That doesn't work - the American model doesn't travel. The Spectator version is very English: that uniqeness surely gives it a chance of success.

Friday 9 May 2008

More on Soros

Controlled Greed, which is one of the best financial blogs, is taking my argument on Soros as bit further.

Thursday 8 May 2008

George Soros

In the Spectator this week, I'm disucssing George Soros's new book, and his predictions of financial collapse. It's quite a harsh piece, but Soros is given far to soft a ride by most of the media. He has been predicting the demise of the capitalist system for about a decade now, and, although there are quite a few wobbles, there isn't much evidence of it crashing yet. He should be challeneged more.

Sunday 4 May 2008

Blairism/Gaullism

Reading through the avalanche of comment on Labour's terrible showing in the local elections last week one thing struck me. Lots of people keep sayingt that at least things can't get much worse (in much the same way as they used to keep telling us not to underestimate Gordon Brown). But why not? Blair-ism, to which Brown is really the inheritor, might turn out to be somethinglike Gaullism, a political movement built around a single personality. Without Blair, it might just collapse, much as Gaullism collapsed without the General. After all, it doesn't really represent anyone, nor does it have any genuine values or beliefs. If the Lib Dems were smart, which they aren't, they would realise there is a massive opportunity to make themselves the party of the centre left whilst Brown takes Labour into meltdown.

Thursday 1 May 2008

British Banks

In my Bloomberg column yesterday I mainly focussed on British banks. People are over-looking the extent to which the banks are going to get blamed for the housing crash that now looks inevitable. They are going to be pressurised to cut their margins to bring mortgage rates down - although its not their fault money has become more expensive. And once the repossessions start, they are going to come under a lot of pressure to give people mortage holidays to keep them in their houses. All that is going to cost a lot of money and that is going to come out of the profits of the banks.

Tuesday 29 April 2008

Trading Post - Squandered

In the latest episide of the Spectator TV show I've been producing - Trading Post - I spoke with David Craig, who's book 'Squandered' brilliantly skewers Gordon Brown. David is a really interesting person to speak to. He's a very quiet, slightly nerdy, former management consultant who has made a specialism of taking apart the madness of a tidal wave of government spending. His anger is all the more effective for being very quiet.

Monday 28 April 2008

Ken for Labour Leader

I'm straying off the usual topics of this blog here, but no one seeems to have mentioned yet the possibility of Ken Livingstone as the next Labour leader. Here's the scenario in which it happens. Ken gets beaten this week, and attacks Gordon Brown for losing him the election. He finds himself a safe Labour seat for the next election. After Gordon leads Labour to its inevitable defeat, they will be looking for a new leader -- and preferably one not tainted by the whole Brown/Blair era. Labour doesn't have any other substantial figures - so why not Ken? He certainly has the ego and the charisma. Right now, he hardly even figures in the odds. Ladbrokes have him at 100-1, the same as Hazel Blears . That might well be worth a flutter.

Thursday 24 April 2008

Bank of England

Speaking of the Bank of England and its rescue plan, Mark Gilbert on Bloomberg is a must-read today.

Monday 21 April 2008

Mervyn King

Mervyn King is erudite and articulate and sometimes quite funny. But it still seems to me that he is getting an extrordinarily soft ride from the media for his handling of the credit crunch (probably because everyone is too busy beating up Gordon Brown). He spent most of the autumn lecturing evryone about moral hazard, suggesting that he wouldn't bail out the banks. Central banks, he said in September, should only act when there are "economic costs on a scale sufficient to ignore the moral hazard in the future." And yet in reponse to house price falls of, at most, 1% or 2% he's decided to start swapping gilts for mortgages. Whether its a good or bad idea, its certainly not consistant with what he was telling the markets a few months ago. So why should anyone believe the bank again?

Friday 18 April 2008

Trading Post

You can catch the latest episode of the Spectator Business TV show I'm presenting here. Interviewing John Meadowcroft was particularly interesting. We get a constant clamour in the media calling for things to be banned, so it is good to open up some space for the contrary argument to be heard.

Wednesday 16 April 2008

Credit Crunch

My Bloomberg column is also running on the Telegraph website this morning. There is endless discussion about how to bring in new regulations to stop another credit crunch. None of it seems wothwhile, however. If you live in a free market economy - and its a lot better than any other system - then you have to expect a certain amount of volatility. People experiment, create new markets, then test them to destruction. The debate should be about how to mitiagte the impact of that volatility -- not about how to stop it from happening.

Saturday 12 April 2008

Zimbabwe

There's a fascinating article on The First Post about the pros and cons of military intervention in Zimbabwe. The sequal to Death Inc which I am working on at the moment plays around with that very issue, although in the guise of a thriller. The arguments would actually be pretty good: there is no doubt that an outside army intent on disposing Mugabe would be welcomed by the people there. The trouble is, the Iraq war has so discredited the idea of military intervention, there would never be any support for it.

Wednesday 2 April 2008

British Economy

The forecasts for the British economy are still far too optimistic. In my Bloomberg column today, I quote Lehman Brothers as saying there is a 35% chance of a recession. I think that is too low. A combination of a housing bubble, a currency bubble and an immigration bubble have kept the British economy going. People have factored in the end of the housing bubble. They haven't started thinking enough about what happens once the currency starts falling and the East Europeans start going home. That's when it will start to get painful.

Sunday 30 March 2008

Mark Thatcher

For someone who is writing a series of military thrilers about mercenaries, the Simon Mann story just gets better and better. The involvement of Mark Thatcher, now wanted for in Equatorial Guinea for his role in the alleged coup, just makes it even better. Thatcher, of course, denies any role. But a PM's son plotting a coup...it's hard not to see the beginnings of a plot there.

Friday 28 March 2008

Trading Post

I have been working on a new web TV programme for the Spectator called Trading Post. You can watch the first episode here. It's been an a fun experience so far. There's a lot of TV out there, but it is either very news driven, like Bloomberg and CNBC, or else it is pitched a very broad audience like the BBC. This gives us some space to discuss issues and ideas in an intelligent way.

Wednesday 26 March 2008

European Bank Crisis

In my Bloomberg column today, I'm discussing the potential for a European banking crisis. There's a lot of complacency aroud what happens if a Greek, or Irish or Spanish bank goes bust.

Sunday 23 March 2008

Apple Nutters

The New York Times has a lovely piece today discussing how anybody who writes anything negative about Apple gets deluged with hate mail. Too true. A while ago, I wrote a column for Bloomberg suggesting the iPhone was, to put it mildly, a bit over-hyped. It was a pretty good argunent. The iPhone is still, so far as I can see, an expensive niche product. It hasnt' t turned the mobile phone industry upside down. But I received - and still receive - dozens of mad e-mails. How can anyone get that passionate about a gadget company that makes computers and MP3's players is beyond me? I mean, if you are going to be passionate about something, couldn't it be something political, spiritual or artistic?. Add in the fact that the business is run by a man who is easily the most unpleasant individual I have ever met - Steve Jobs - and their devotion seems even sadder. Still, I feel sory for the NYT. They'll be getting abusive e-mail for months.

Friday 21 March 2008

The Web: Telecoms or Media?

I interviewed Clay Shirky this week for a new TV programme I am presenting for the Spectator. More on that later. Clay has a fascinating new book out on the impact of social media called 'Here Comes Everybody'. It's full of well-tuned insights into the web. One that struck me as telling was his point about use-generated content. Lots of people - particularly in the mainstream media - complain that the postings on blogs, the clips on YouTube, the homepages on MySpace etc are rubbish. And, of course they are, at least compared to professionally produced material. But Clay's point is that we should think of them more like phone calls than broadcasts. The fact that they are amateurish doesn't matter, becuase they are only intended for a few people anyway. There's a lot of truth in that. The point about the web is that it is really a development of the telephone. Once you take that on board, everything becomes a lot clearer.

Tuesday 18 March 2008

What's Bear Worth? Nothing.

Felix Salmon is pointing out on his Portfolio blog that Bear Stearns is still trading at more than twice the price JP Morgan (or rather the American government) is paying for it. And it's true. It's quoted at $4.81 this morning, compared to the $2 it is being sold for. Clearly, some people in the market think the JP Morgan deal won't go through. They are betting the bank can be revived. Now, it may well be true that Bear is worth a lot more than $2 and JP Morgan is getting the steal of the century. But investors such as RAB Capital thought the same about Northern Rock in Britain, and they ended up losing a packet. Once a bank has to be rescued by the government, there is no point in betting against the deal.

Monday 17 March 2008

Bear Stearns vs Northern Rock

One of the fascinating aspects of the Bear Stearns rescue over the weekend is the way it contrasts with the dithering over Northern Rock in the U.K. Both banks were clearly running out of cash. But the Federal Reserve acted decisively, and forced Bear into a takeover, even through it meant making massive loans to JP Morgan. In Britain, that is what should have happened to Northern Rock. A takeover by Llloyds TSB should have been arranged over the weekend, even though the government would have had to guarantee its loan book. It would have been far better than six months of indecision followed by nationalisation.

Friday 14 March 2008

Tax Havens

A Bloomberg column I wrote about Germany's attack on Lichtenstein has provoked an interesting discussion over at Samizdata.net plus some further analysis by the Cato Institute. I was mainly struck by how the Germans thought it was okay to be pay for data to be stolen from a foreign bank -- and then the British government paid for a copy of the list. How would they feel if the Iranians stole data from Deutsche Bank or Barclays? But at Samizdata they've taken the whole discussion a lot further.

Thursday 13 March 2008

Simon Mann

The British mercenary Simon Mann has been in the news again for his role in organising a coup in the African state of Equatorial Guinea. We'll be following the case with interest on this blog: in part because Death Inc is about a gang of mercenaries: and, probably more importantly, because its sequal is going to be set in an African state, although one that's quite a bit further south than Equatorial Guinea. I'll get into the details later on, but it strikes me that Mann is the last of the old-school mercenaries, a daring, but amateur freelancer. Since then, they've morphed into Private Military Corporations, and tried to make themselves respectable.

Wednesday 12 March 2008

Budget

In my Bloomberg column this week, I'm arguing that Alistair Darling's first budget should be his last. Having caught the headlines from what appeared to be an incredibly dull statement, I can't see anything to change that view

Saturday 8 March 2008

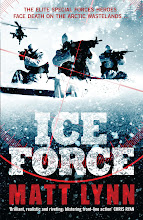

Death Inc

This blog has been created to discuss my new novel, Death Inc, which is published by Headline later this year.

Subscribe to:

Posts (Atom)